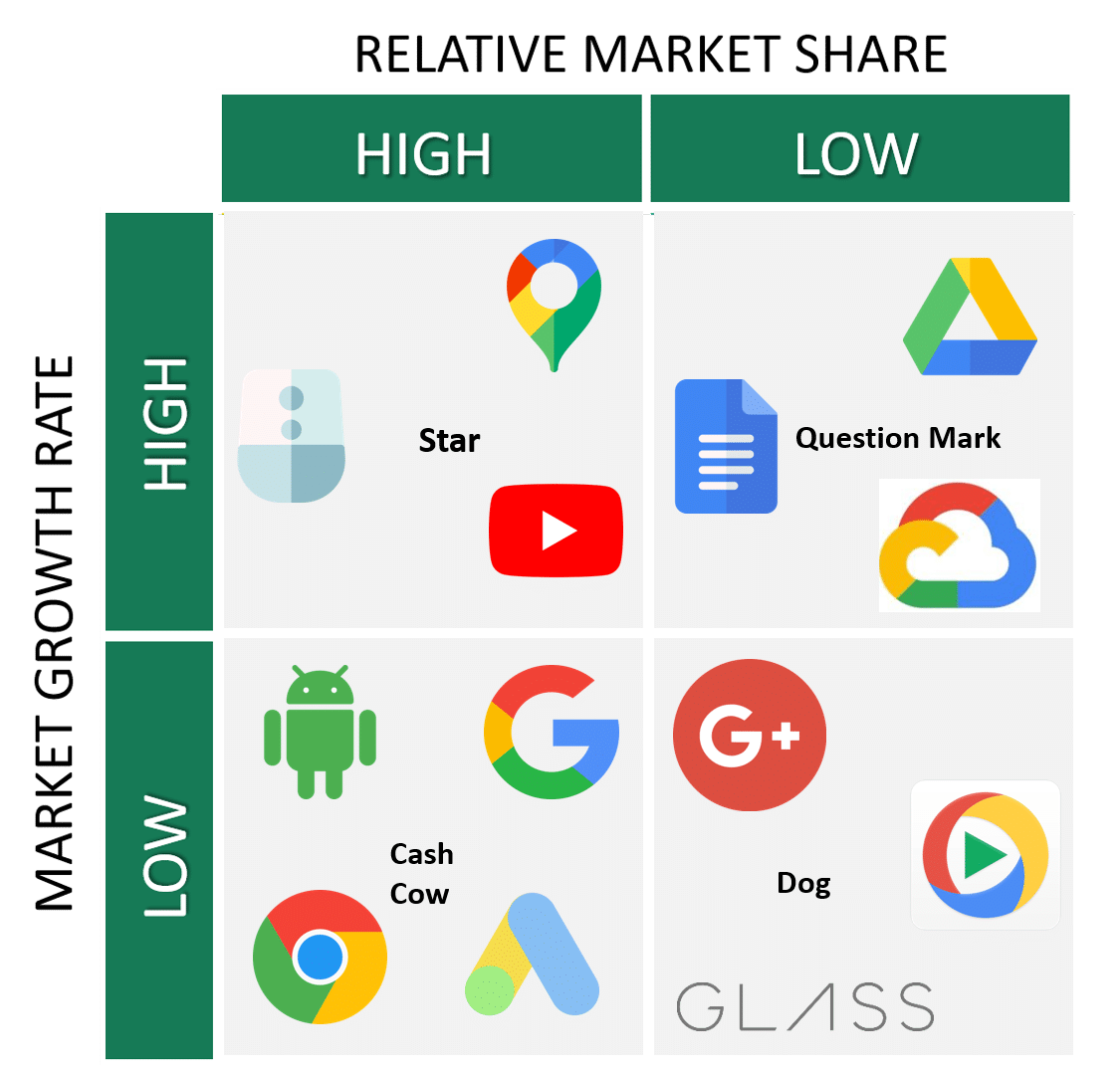

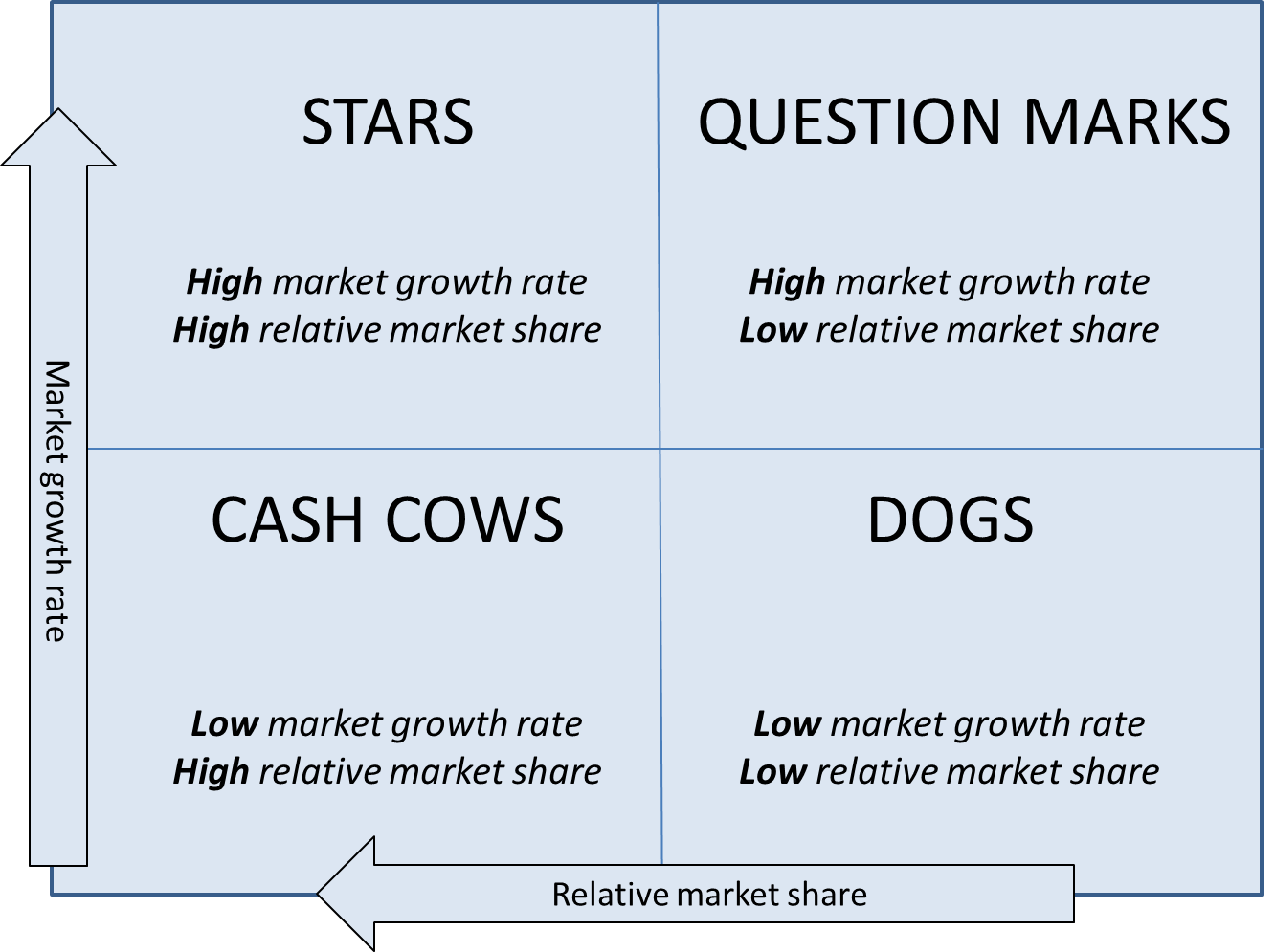

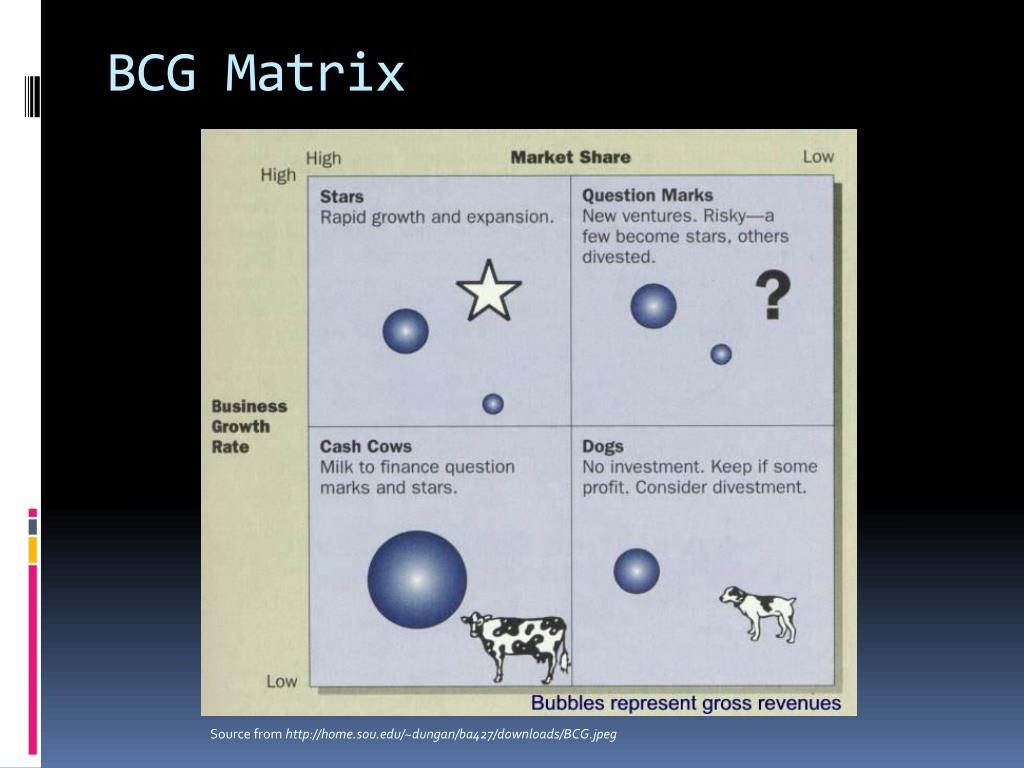

If Samsung only had a share of 10%, the ratio would be 2:1 (2.0), implying that Philips is in a relatively strong position. This is because the company benefits from scale economies and thus gains cost leadership over its competitors.įor example, if Philips has a 20% market share in the mobile phone industry and Samsung (its largest competitor) has 60%, the ratio would be 1:3 (0.33) implying that Samsung has a relatively weak position. The framework assumes that an increase in relative market share will result in an increase in the cash flow. The exact measure for relative market share is the company’s share relative to its largest competitor. Depending on their market performance, products can be classified into one of the four categories (quadrants):īruce Henderson, the creator of the BCG Matrix used this variable to measure a company’s competitiveness. By combining these variables into a matrix, a company can pivot their products and determine where to allocate its resources, where to maximize its cash flows and where to divest. The purpose of BCG Matrix is to make product investment decisions at a strategic level.The matrix is used in corporate strategy to analyze business units or product lines based on two variables: relative market share and the market growth rate. The Growth-Share Matrix (also known as the Product Portfolio matrix) is a tool developed by Boston Consulting Group (BCG).

This allows a company to determine whether they should invest in a product or whether they should de-invest, or even stop the product altogether. Sales for the year came in at $29.29 billion, compared to $31.86 billion in 2021.In the BCG matrix, market growth and market share of the products (or service) of a company are compared to each other. Apple's tablet continues to show low growth, as sales continue to decline.

Sales for Mac products came in at $40.18 billion for the fiscal year (FY).

0 kommentar(er)

0 kommentar(er)